Navigating the mysteries of pet insurance can feel daunting. But with a little guidance, you can successfully choose a plan that meets your furry friend's needs and provides financial security. This detailed guide will explore the fundamentals of pet insurance, assisting you to make an wise decision. From knowing different website policy types to comparing coverage options and selecting the right insurer, we've got you covered.

- Let's investigating the various types of pet insurance available.

- Learn about accident-only, total coverage, and preventive care plans.

- Then examine factors to consider when selecting a policy, such as deductibles, fees, and reimbursement rates.

Ultimately, this guide aims to equip you with the knowledge needed to make an well-informed choice about pet insurance.

Comprehending Your Coverage: How Pet Insurance Works

Bringing a furry friend into your life is an amazing experience, filled with love, laughter, and plenty of tail wags. But as any pet parent knows, unexpected vet bills can quickly develop a major financial concern. This is where pet insurance comes in! It provides valuable protection for your beloved companion by helping to cover the costs of unexpected medical needs.

- Pet insurance typically works by you paying a monthly premium.

- In exchange, when your pet requires veterinary care, your insurer will reimburse you for eligible expenses according to your chosen plan.

- It's important to carefully examine the different types of coverage available to ensure you find a policy that matches your pet's individual needs and budget.

Remember, not all plans are created equal! Some may avoid certain illnesses. By comprehending your coverage, you can be ready to handle unexpected veterinary costs with assurance.

Furever Friends Insurance

Pet insurance can feel like a complicated subject, but it doesn't have to be! Basically, it's a safety net for your furry best friend. Just like health insurance for humans, it helps cover the price of unexpected vet bills. Whether your pup needs surgery, has a sudden illness, or even just requires routine checkups, pet insurance can provide much-needed financial support.

It's important to shop around and find a policy that best fits your animal's needs and your budget. Don't wait until an emergency happens – get protected today!

Can You Afford Pet Insurance?

Deciding whether or not to get pet insurance can feel overwhelming. After all, you want the best care for your furry friend but also need to weigh the costs. This step-by-step guide will help you figure out if pet insurance is right for your situation.

- Begin with assessing your companion's health history.

- Consider the potential for future vet expenses.

- Look into different insurance policies.

- Review coverage levels, premiums, and deductibles.

- Make an thoughtful decision based on your financial situation.

Deciphering the Mystery of Veterinary Bills with Pet Insurance

Planning for unexpected expenses when it comes to your furry companion's health can be challenging. Veterinary bills can rapidly mount, leaving pet owners desperate about how to afford the required care. Luckily, there's a solution: pet insurance! This valuable resource can help mitigate the financial pressure of unexpected veterinary situations. By understanding how pet insurance operates, you can securely navigate those unexpected medical requirements and focus on what matters most: your pet's well-being.

Paying for Paws: Understanding Pet Coverage

Providing exceptional healthcare for your furry companion shouldn't be a financial burden. Pet insurance can act as a valuable tool to help you cover unexpected animal expenses, offering peace of mind and ensuring your beloved pet receives the best possible care. With a range of plans available, it's important to research your needs and choose a policy that provides comprehensive protection.

- Understanding the Different Types of Pet Insurance Coverage:

From basic plans to full options, explore the various levels of coverage available to determine which best suits your pet's needs and your budget. - Factors to Consider When Choosing a Pet Insurance Plan:

Age can influence premium costs. Evaluate different providers to discover a plan that offers competitive premiums and comprehensive benefits. - The Benefits of Pet Insurance:

With pet insurance, you can minimize the financial stress associated with unexpected healthcare costs. This allows you to prioritize on your pet's well-being without worrying about costly veterinary bills.

Haley Joel Osment Then & Now!

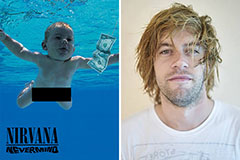

Haley Joel Osment Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!